What is Five Forces Analysis

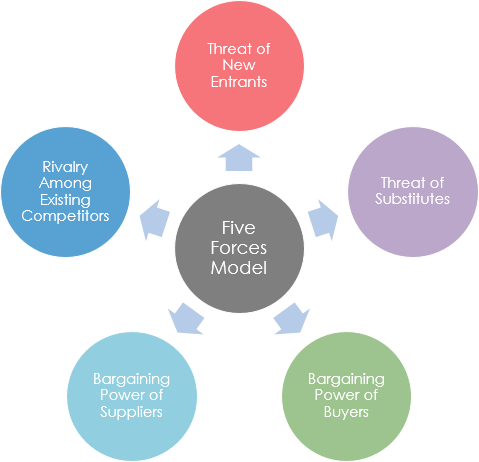

The Five Forces Analysis is an framework to understand the competitive dynamics of an industry. It allows businesses and other stakeholders to evaluate the attractiveness and competitiveness of an industry. It is a lens through which one can assess how competition and power are distributed within an industry.

This framework, developed by Michael E. Porter in 1979, is based on the premise that five fundamental forces drive industry competition. An understanding of these forces can help an organization strategize effectively to protect its market position or gain a competitive advantage over rivals.

Porter's Five Forces Analysis Tutorial

Role in Strategic Management

The Five Forces Analysis plays a critical role in strategic management by helping organizations understand the external competitive environment in which they operate. Each of the five forces provides specific insights:

Threat of New Entrants

The threat of new entrants refers to the possibility of new competitors entering an industry. If it is relatively easy for new companies to enter the market, this can erode existing firms’ market share and profitability.

Factors affecting the threat of new entrants include:

-

Barriers to Entry

High capital requirements, customer loyalty, economies of scale, and regulatory constraints can deter new competitors. -

Brand Identity and Customer Loyalty

Established brands with loyal customer bases are less susceptible to new entrants. -

Access to Distribution Channels

The easier it is for a new entrant to distribute its products, the higher the threat.

Strategies to mitigate this threat include creating strong brand identities, building customer loyalty, and exploiting economies of scale.

Bargaining Power of Buyers

The bargaining power of buyers involves customers' ability to put the firm under pressure, which also affects the customer's sensitivity to price changes.

Factors affecting the bargaining power of buyers:

-

Number of Customers

Fewer buyers, the more each buyer can demand better deals. -

Availability of Information

The more information buyers have, the harder they can negotiate. -

Importance of Each Buyer

If buyers purchase in large volumes or have significant leverage, they can negotiate for discounts or more favorable terms.

Strategies to deal with powerful buyers include developing innovative products, improving customer services, and building strong relationships with profitable customers.

Bargaining Power of Suppliers

This force addresses how easily suppliers can drive up the cost of goods or services. It is affected by the number of suppliers of key aspects of a product or service, how unique these aspects are, and how much it would cost a company to switch from one supplier to another.

Factors affecting the bargaining power of suppliers:

-

Number of Suppliers

The fewer the number of suppliers, the more power they have. -

Uniqueness of Service or Product

If a supplier offers a unique product, they can charge more. -

Switching Costs

The higher the cost to switch to another supplier, the more power a supplier has.

To mitigate supplier power, companies can seek to build strong relationships with suppliers or to change production processes.

Threat of Substitute Products or Services

Substitutes are alternative products or services available in the market that can satisfy the same customer need as the company’s product.

Factors that affect the threat of substitutes:

-

Relative Price Performance of Substitutes

If substitutes are more affordable and offer the same level of satisfaction, the threat is high. -

Buyer’s Willingness to Substitute

The ease with which buyers can switch to another product or service. -

Perceived Level of Product Differentiation

If products are highly differentiated, substitutes are less threatening.

Companies can counter this threat by offering better quality, innovation, or other differentiating factors.

Intensity of Competitive Rivalry

Competitive rivalry is the extent to which firms within an industry put pressure on one another and limit each other’s profit potential. If rivalry is intense, companies may need to offer more competitive prices, which can affect the profit potential.

Factors affecting the intensity of competitive rivalry:

-

Number of Competitors

Higher numbers of competitors can increase the rivalry. -

Industry Growth

Slow growth industries can have more rivalry as firms fight for market share. -

Diversity of Competitors

When competitors offer diverse products and strategies, rivalry can be more unpredictable.

Strategies for dealing with intense rivalry include differentiation, finding a niche market, or achieving lower-cost production than rivals.

Case Study: Five Forces Analysis of the Electric Vehicle Industry

I will show you a case study that examines the Electric Vehicle (EV) industry through the lens of Porter’s Five Forces Analysis. The EV market is a rapidly evolving segment within the automotive industry and is characterized by technological innovation, changing consumer preferences, and increasing environmental concerns.

Threat of New Entrants

In the EV industry, the threat of new entrants is relatively high.

-

Capital Requirements

Although the need for capital is significant, numerous start-ups are entering the market, often backed by venture capital or through partnerships with existing manufacturers. -

Technological Innovation

Companies with innovative technologies can break into the market more easily. For instance, Tesla’s battery technology was a key factor in its successful market entry. -

Regulatory Support

Governments worldwide are pushing for cleaner energy solutions. This support lowers barriers to entry as new entrants can avail themselves of incentives and subsidies.

Bargaining Power of Buyers

The bargaining power of buyers in the EV market is moderate.

-

Brand Loyalty

Some brands, such as Tesla, have strong brand loyalty, which reduces buyers' bargaining power. -

Availability of Alternatives

As more companies enter the EV market, consumers have a broader range of options, increasing their bargaining power. -

Government Incentives

In some regions, governments offer incentives to buy electric vehicles, giving consumers more leverage.

Bargaining Power of Suppliers

In the EV industry, the bargaining power of suppliers is mixed.

-

Battery Suppliers

As batteries are a crucial component of EVs, companies providing advanced battery technology can wield significant bargaining power. -

Standard Components

For more generic components, automakers may have various supplier options, reducing the bargaining power of suppliers.

Threat of Substitute Products or Services

The threat of substitutes is moderate.

-

Hybrid Vehicles

These can be considered a substitute for electric vehicles as they also offer fuel efficiency and reduced emissions. -

Traditional Gasoline Vehicles

Despite the shift towards greener alternatives, gasoline vehicles remain a viable substitute, especially in regions where the cost of electric vehicles remains high. -

Alternative Transportation

Car-sharing services, public transportation, bicycles, and even new forms of mobility such as e-scooters are alternatives to owning an electric vehicle.

Intensity of Competitive Rivalry

The intensity of competitive rivalry in the EV industry is high.

-

Market Leaders

Established players like Tesla, Nissan, and Chevrolet are continually innovating. -

New Entrants

New entrants like Rivian, NIO, and others are intensifying the competition. -

Traditional Automakers

Traditional automotive giants like Ford and Volkswagen are entering the EV market with significant resources at their disposal.